Latinos statistically live longer than whites and blacks, and are more likely to rely on Social Security — and live in poverty — in their retirement. That's scary.

Latinos statistically live longer than whites and blacks, and are more likely to rely on Social Security — and live in poverty — in their retirement. That's scary.

Millennial Hispanics are in "survival mode," and not inclined to be more strategic with their finances, says one financial expert.

This is why we're organizing a Money Matters Expo: To help Latinos improve financial literacy. This is an urgent situation. We found the following information in an alarming CNN Money report:

"We have that huge swath of the demographic that is underprepared and underfunded and Social Security is not going to be enough," said Ramona Ortega, founder of Mi Dinero Mi Futuro (My Money My Future), a financial technology company that helps Hispanic millennials manage their money.

Related story: GBLN felt a sense of urgency to create the Money Matters Expo

When they do have access to employer retirement plans, Hispanic workers generally don't contribute as much to those plans "either because they can't afford it or because they don't understand it," Ortega said.

Hispanics are also less likely to buy life insurance and more likely to borrow against their 401(k), she added.

Hispanics are also more likely to rely on family for financial support. While that provides a certain amount of security and stability, it can also come at a cost for younger family members.

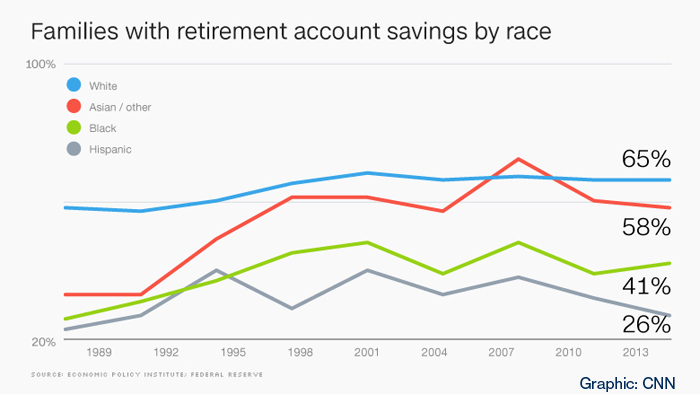

According to data from the Economic Policy Institute, only 26 percent of Hispanic families had savings in a retirement plan like a 401(k) or IRA, in 2013.

That's well lower than white, black or Asian families in the United States.

How did this happen? Part of the reason is that many Hispanics, particularly those that work in low wage jobs, don't have access to retirement plans, said Monique Morrissey, an economist at the EPI who spoke to CNN, which first reported these figures.

How did this happen? Part of the reason is that many Hispanics, particularly those that work in low wage jobs, don't have access to retirement plans, said Monique Morrissey, an economist at the EPI who spoke to CNN, which first reported these figures.

Immigrant Hispanics, for example, often have to work off the books. That means no access to retirement accounts. Native born Hispanics, however, participate in rates closer to African Americans, Morrissey said.

"Most whites are not doing well, blacks and Hispanics are doing terrible and immigrant Hispanics are doing the worst of all when it comes to retirement savings," Morrissey said.

Low rates of participation also contribute to low rates of retirement savings. In 2013, white workers between the ages of 32 and 61 had an average of $125,000 in retirement savings compared to $26,500 for blacks and $16,800 for Hispanics. For Asians and those of other races or ethnicities, the average retirement savings in 2013 was $100,000.

"[The] savings in these accounts magnify income inequality," Morrissey said.

The retirement savings gap also closely mirrors the overall racial wealth gap in America. Wealth, or net worth, is the value of assets including your home, retirement savings and income minus the debt owed against those assets. According to federal data, the median wealth for white families in 2013 was around $141,900, compared to Hispanics at about $13,700 and blacks at about $11,000.

Access is another issue. Hispanics and blacks often work for small businesses and in low-wage, non-union jobs that offer few retirement savings options, Morrissey said. Public sector jobs with secure pensions have also been on the decline.

Since Hispanics are more likely to live longer than blacks and whites, they are also more likely to work longer into their old age, Morrissey said. Some Hispanic workers "are going to work longer, and they are going to rely on their families and they are going to be poor," she said.

GBLN Money Matters Expo

With the rallying cry of "¡Invierte en tu Futuro!" ("Invest in your Future!"), Money Matters Expo at HCC is Saturday, Sept. 16, 2017 at Housatonic Community College's Beacon Hall, 900 Lafayette Blvd., Bridgeport. The event begins at 10 a.m. and ends at 1 p.m.

See exhibits and speak directly to experts and discuss:

First-time homebuyers Q&A

Estate planning

College savings

Living wills

Disability insurance

Social Security information

And more